US Tariff Hikes – Impact on Carbon Fiber and Composites

👁 Reads: 908

The recent increase in US tariffs on imported carbon fiber and composite materials has sparked significant concerns among manufacturers, importers, and trade analysts. This article explores the implications of these tariff hikes, their impact on the supply chain, and strategies for navigating this evolving trade landscape.

What Is the New US Tariff Change?

The US government has introduced higher tariffs on carbon fiber imports as part of its broader trade policy aimed at protecting domestic industries. These tariffs are tied to environmental concerns, with some proposals suggesting fees based on greenhouse gas emissions from producing these materials abroad. While details vary, the overarching goal is to reduce reliance on foreign suppliers, particularly from China and Russia.

Implemented in phases starting January 2025, with full enforcement scheduled for July 2025, these tariff increases represent the most significant trade policy shift affecting composite materials since 2018. The six-month transition period allows for inventory adjustments, but many manufacturers report accelerating imports before the final deadline.

The US government has introduced higher tariffs on carbon fiber imports as part of its broader trade policy aimed at protecting domestic industries. Effective March 2025, tariffs on carbon fiber materials from targeted countries have increased from the previous 7.5% to 25% for raw carbon fiber tow and from 4.2% to 17.5% for prepreg materials. This represents part of the broader Section 301 tariff expansion, which specifically targets advanced manufacturing materials. The US Trade Representative cited national security concerns and unfair trade practices as key justifications for these increases.

These tariffs are complemented by a proposed Carbon Border Adjustment Mechanism (CBAM), similar to policies implemented in the EU. Under this framework, importers would pay fees based on verified carbon emissions from production processes abroad. For carbon fiber—an energy-intensive product—this could add an estimated 8-12% to costs from countries with coal-dependent manufacturing like China, where carbon fiber production generates approximately 30kg CO₂ per kilogram of material, compared to 14kg CO₂ in the US.

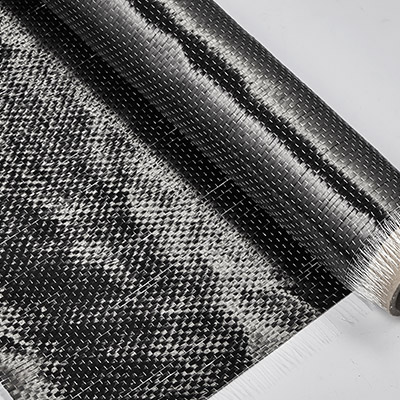

Which Carbon Fiber Products Are Affected?

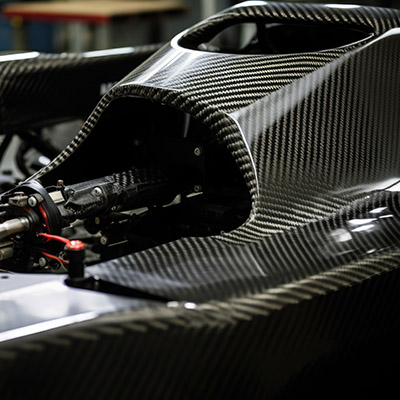

The tariff hikes primarily target industrial-grade carbon fiber used in aerospace, automotive, and construction sectors. Products such as prepregs (pre-impregnated composite fibers) and raw carbon fiber materials are subject to increased import duties. These changes disproportionately affect countries with high export volumes to the US, like Japan and Germany.

According to 2024 trade data, Japan accounts for 31% of US carbon fiber imports by value ($412M annually), followed by Germany (24%, $318M), China (17%, $226M), and South Korea (9%, $119M). Japanese suppliers like Toray Industries and Teijin, who specialize in aerospace-grade carbon fiber, face significant market disruption despite their long-standing quality reputation and established supply chains with US manufacturers.

Impact on Cost and Supply Chain

The higher import duties have led to:

- Increased Costs: Carbon fiber prices have surged due to added tariffs, forcing manufacturers to reevaluate procurement budgets.

- Supply Chain Disruptions: Importers face delays as they navigate new compliance requirements and adjust sourcing strategies.

- Competitive Pressure: Domestic suppliers may benefit in the short term, but limited capacity could lead to bottlenecks.

For example, aerospace companies relying on imported carbon fiber for lightweight aircraft components are now grappling with higher costs and potential delays in production schedules.

How It Affects US Buyers

US buyers, including OEMs (Original Equipment Manufacturers) and B2B distributors, are experiencing:

- Price Hikes: Increased costs are being passed down the supply chain, affecting product pricing for end-users.

- Reduced Choices: Limited access to high-quality imported composites may hinder innovation in industries like automotive and renewable energy.

- Uncertainty: Procurement teams face challenges in forecasting costs amid fluctuating trade policies.

Alternatives: Local Sourcing & Partnerships

To mitigate these challenges, businesses are exploring alternatives such as:

- Local Sourcing: Investing in domestic production capabilities to reduce reliance on imports.

- Strategic Partnerships: Collaborating with regional suppliers to secure stable supply chains.

For instance, some automotive manufacturers are partnering with US-based composite producers to ensure consistent material availability.

Short-Term vs Long-Term Outlook

Short-Term: The immediate impact includes higher costs and logistical hurdles. Companies may need to absorb these expenses or pass them onto consumers.

Long-Term: Over time, increased investment in domestic production could strengthen the US carbon fiber industry. However, global trade tensions may persist, requiring ongoing adaptation by stakeholders.

Conclusion & Strategic Tips

The US tariff hikes on carbon fiber imports present both challenges and opportunities. To navigate this environment:

- Diversify Suppliers: Build relationships with multiple vendors to reduce dependency on a single source.

- Invest in Domestic Production: Explore opportunities for local manufacturing to enhance supply chain resilience.

- Monitor Trade Policies: Stay updated on tariff changes to proactively adjust procurement strategies.

By adopting these measures, manufacturers and buyers can minimize disruptions while positioning themselves for long-term growth in a competitive market.

The recent U.S. tariff hikes on imported carbon fiber and composite materials have led to increased production costs for manufacturers, particularly those reliant on international suppliers. This has resulted in higher consumer prices and reduced profit margins, especially for small and medium-sized enterprises.

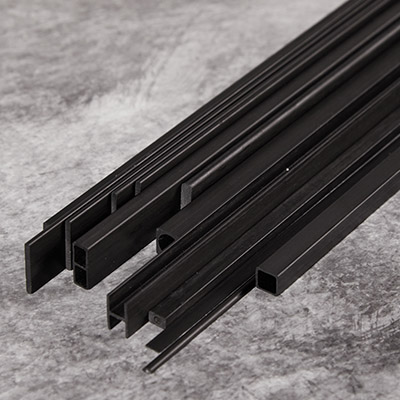

Amid these challenges, NitPro Composites stands out as a leading supplier in the U.S. and Europe, offering high-quality carbon fiber products such as rods, tubes, sheets, and molded parts. With in-house manufacturing capabilities and a commitment to customization, NitPro ensures consistent supply and competitive pricing, helping clients navigate the complexities of the current market landscape.